Building Your Financial Roadmap

Comprehensive, flat-fee financial planning services tailored to align with your personal values and goals. We focus on simplifying and consolidating your financial life by providing proactive solutions and personalized support to empower your financial journey.

We design comprehensive, written, step-by-step financial plans aligned with your values and goals. Whether you’re focused on retirement, managing income, saving for college, or planning for any other financial goals, we help you build a clear path forward. We help coordinate, consolidate, and simplify your personal finances.

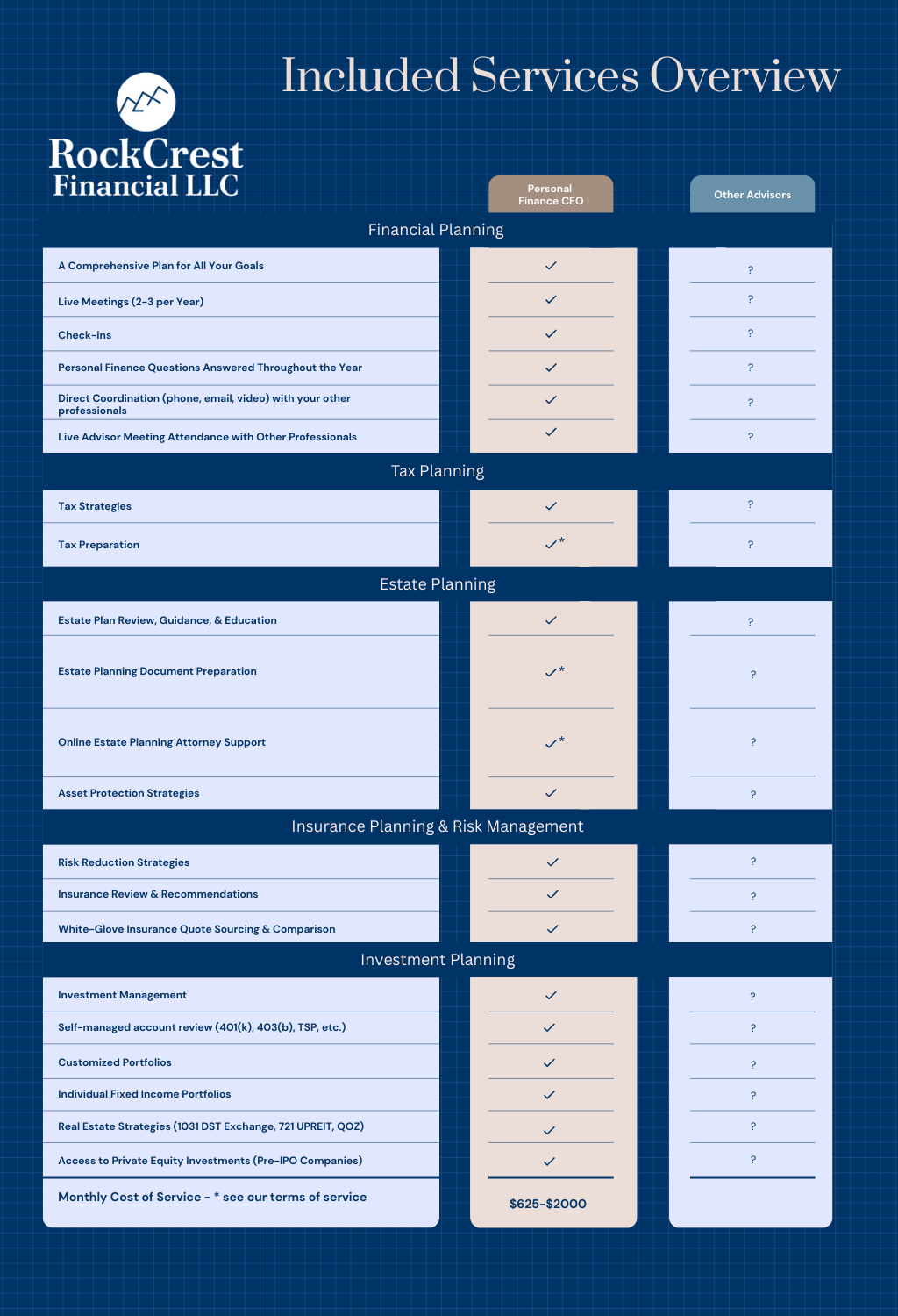

We offer both customized and model investment portfolios designed to align with your risk tolerance, timeline, and financial goals. We’ll also review and integrate accounts we don’t manage directly, like 401(k)s or other employer-sponsored plans. We provide advice across your portfolio, helping ensure your investments work together. Our advanced strategies include (when applicable):

We help you stay proactive with strategic tax planning and strategies, like tax-loss harvesting, backdoor Roth IRA conversions, and optimizing credits and deductions. We also offer tax preparation services through our trusted partner firms.

We review your wills, trusts, and powers of attorney to ensure they are current and aligned with your goals. Our role is to educate and guide you through the estate planning process so that your plan accurately reflects your wishes. We also provide access to estate document preparation and attorney consultations through our network of trusted partner firms.

As your advisor, we provide an unbiased evaluation of your risks. We’ll evaluate your risks and tell you if you need insurance, how much you should have if it’s needed, and what’s the right type of insurance for you.

You’ll have access to up to three in-person meetings per year, depending on the complexity of your plan. In between, you can reach out anytime for support via email, phone, or virtual meetings. Think of us as your on-call financial resource.

We take an active role in coordinating and communicating with the other professionals in your life—your accountant, estate attorney, insurance agent, banker, mortgage agent, and more. We help ensure they’re on the same page with your financial plan and we hold everyone on the team accountable. When needed, we communicate with these professionals on your behalf throughout the year.

Our platform offers a streamlined way to view your entire financial picture in one place. You can easily access information on all your financial accounts, budgeting and spending tools, tax projections, estate plan details, insurance coverage, key financial documents, professional contacts, and information about your family and beneficiaries — all in one secure, centralized hub.

RockCrest Financial Reviews

As a stand-alone service, we can help:

We provide investment management only services to a limited number of clients for 0.96% of AUM.

Advanced Investment Management

Advanced Tax Planning & Analysis

Estate Planning – including in-depth review of Wills, Trusts, and POAs

Coordination, Communication and Accountability with your Accountant, Estate Planning Attorney, Insurance Agents and Other Financial Professionals

Meeting Attendance with your Other Advisors (Upon Request)

Investment Management

Tax Planning & Analysis

Estate Planning – including basic review of Wills and POAs

Investment Management

We provide investment management only services to a limited number of clients for 0.96% of AUM.

We provide one-time financial planning services to a limited number of clients. The cost of a one-time comprehensive written financial plan ranges from $2,500 to $5,000 depending on scope and complexity.

HNW couples/families/business owners with complex situations/multiple goals who wish to delegate financial tasks and problems ($1-10 mil Net Worth)

People interested in health and wellness and relating that to their personal finances

Real Estate Agents in the growth stage of their career

Gen X

THEY ARE FINANCIAL DELEGATORS and are happy to follow the advice of a team of financial experts, coordinated by a single Trusted Advisor.

THEY ARE PASSIONATE ABOUT THEIR GOALS and realize that achieving them requires time, money and planning.

THEY ENJOY THE SIMPLICITY, FREEDOM, AND PEACE OF MIND that comes from having all of their financial assets under the watchful eye of a single, Trusted Advisor who helps provides oversight, coordinating all personal financial affairs.

THEY VALUE OUR WORK TOGETHER and appreciate advice and guidance. Due to the high level of client interaction and attention, our services make sense for families who have accumulated more than $1,000,000 in assets, not including the value of their home.

THEY FOCUS ON WHAT'S IMPORTANT and delegate financial matters to us. They want an advisor whose role is to help protect their financial assets, and overarching strategy, so they focus on the things which matter most in life to them.

THEY APPRECIATE THE CANDID TRUTH: Our clients want to hear the truth from us regarding their financial situation...no matter what. They rely upon us and want complete transparency about their financial situation and the fees that pay all of their advisors.

FAQ

We act as your financial chief executive officer, leading your personal team of financial professionals (your accountant, attorney, insurance agents, bankers, mortgage agents, etc.), helping you implement and manage a comprehensive, step-by-step financial plan, so you can “live your best life.”

Yes! A fiduciary must act in your best interests, ensuring transparency, honesty, and alignment with your financial well-being. We must put your interests ahead of ours.

We have no strict asset minimums. Our financial planning services are best suited for individuals and families who desire a delegated approach to comprehensive financial planning with a net worth between $1M to $10M, and high-income earners looking to accumulate wealth.

No. Our flat-fee financial planning subscription can be canceled at any time. Please see Services page for more information.

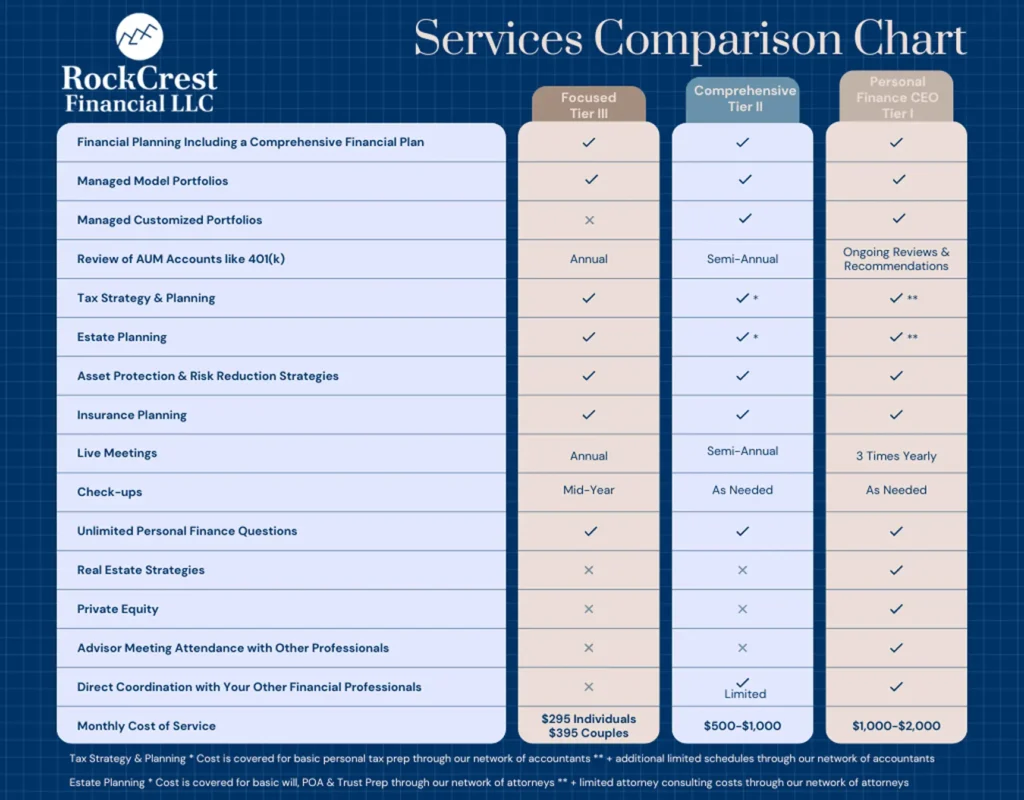

You pay one all-inclusive flat fee, as a monthly subscription, which covers all of our services. The fee is based on the complexity and level of service that you choose. Please see our ADV for more information.

As an independent investment advisory firm, we do not earn commissions or receive compensation for recommending specific products. This structure allows us to minimize conflicts of interest and provide unbiased investment advice.

It’s never too early or too late to take control of your financial future. Contact us today to learn how RockCrest can help you achieve financial independence while protecting your time and lifestyle.

“Your Personal Finance CEO” – RockCrest goes beyond just creating plans and managing assets… we help successful, busy individuals and families achieve financial independence, and protect their lifestyle.

Contact Us

Quick Links

IMPORTANT DISCLOSURE INFORMATION

Advisory services offered through RockCrest Financial LLC, an investment adviser registered with the state of New Jersey and other jurisdictions as required. Registration as an investment adviser does not imply a certain level of skill or training. RockCrest Financial LLC does not provide tax or legal advice, and we encourage you to consult with tax or professional legal advisors before implementing any legal or financial planning strategies. Information presented on RockCrest Financial’s website, as well as social media sites linked on this page, is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any securities. RockCrest Financial’s website and its associated links offer news, commentary, and generalized research, not personalized investment advice. No content on this website should be interpreted to state or imply that any past outcome is indicative of a future outcome.